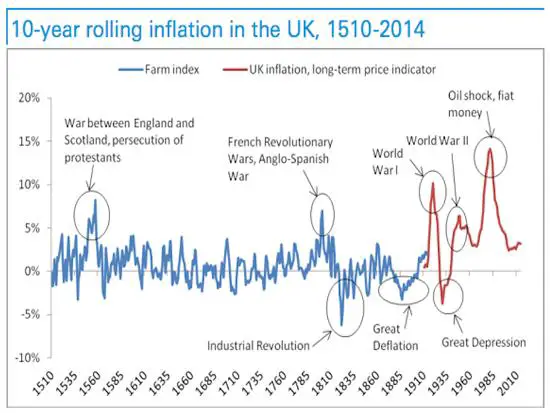

For the first four hundred years depicted here, money was gold and silver — the quantity of which rose at roughly the same rate as the human population. Prices during that time fluctuated, but only modestly by today’s standards, and they always returned to more-or-less the same level. In other words, money held its value for not just years but centuries. It was a fixed aspect of the financial environment and was therefore not a tool of economic policy. Governments and individuals had to adapt to unchanging money rather than forcing money to adapt to political circumstances.

Mon, 2 February 2015

Martin Armstrong says, "Anyone who claims to be not a doom and gloomer is either a sublime idiot or a fool in denial. This is not a system that can be sustained indefinitely." We agree and have been saying this for years. But that doesn't mean you have to be in a depressive funk. There's always humor to be found in every tragedy. Don't believe it, look at Comrade deBlasio. He's always good for a chuckle, whether he's out killing groundhogs or giving away the store. We also talk about a NYC teach who's gotten lousy reviews for 6 years running, is habitually late and absent and can't seem to manage her classroom. Her penalty, 45 days suspension without pay and more coaching. There's no gloom and doom here at FSN, ever!

Comments[0]

|

Mon, 2 February 2015

John writes about Business Insider's recently posted a Deutsche Bank chart that illustrates the difference between life under the Classical Gold Standard and today’s “modern” forms of money. It’s for the UK only but is a pretty good representation of the world in general:

Comments[0]

|

Mon, 2 February 2015

Steve Lord isn't concerned about bitcoin's recent plunge in value. Rather he's looking at Coinbase's recent $75 million raise of capital and sees that as confirmation that Wall Street's interest level is going up. New York State has backed off of much of its proposed draconian regulation of digital currencies and is focusing primarily on exchanges, where there's the highest potential for fraud. Steve and the rest of the world are wondering if the Greeks and other EU citizens will flee to bitcoin, if confidence in European banks keeps dropping, which is already happening. Such an event could easily lead to another rapid appreciation of the digital currency, which could quickly leave the last record in the dust.

Comments[0]

|