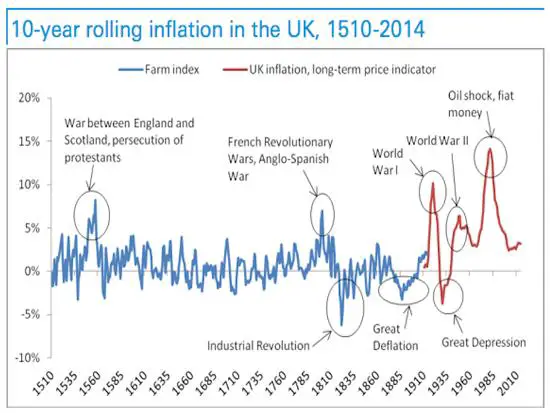

For the first four hundred years depicted here, money was gold and silver — the quantity of which rose at roughly the same rate as the human population. Prices during that time fluctuated, but only modestly by today’s standards, and they always returned to more-or-less the same level. In other words, money held its value for not just years but centuries. It was a fixed aspect of the financial environment and was therefore not a tool of economic policy. Governments and individuals had to adapt to unchanging money rather than forcing money to adapt to political circumstances.

Wed, 11 February 2015

Rob Kirby is first and foremost a seeker of truth. He sees that the globalist system is a method of enslaving humanity. Key to that system was the Euro. With the death of the Euro becoming more likely by the day, he believes that extremely tough times are ahead for all of us. Soon the dominos will begin to fall and it will end with the dollar. Everyone needs to be prepared for this eventuality.

Comments[0]

|

Wed, 11 February 2015

John LeBoutillier and I discussed the latest scandal in New York and its affect upon the political future of the state. John believes that we need a full time legislature and that outside income for the state assembly and senate should be eliminated. This would shut down the major source of corruption. We also discussed the emergence of Scott Walker as the leading Republican presidential contender. John is worried that he won't sustain attacks from Jeb Bush's vicious campaign team. However Walker beat Wisconsin's public unions and the leftist courts, so there's hope that he'll make it. The real question is whether he can beat the mainstream media and that remains to be seen.

Comments[0]

|

Wed, 11 February 2015

Whatever it Takes Wednesdays with Andrew Hoffman: Greece -today's Eurogroup emergency meeting -yesterday's lie of bailout extension, not happening -Russia to rescue?

Euro -Grexit will NOT be good for Euro, will destroy it -explosion of Syriza-like parties in PIIGS -all will want secession from Euro, debt writeoffs

India -Getting rid of all tariffs

Baltic Index -all time low today

Oil prices -plunging again, after failed deadcat bounce -NFP report had just 1,900 energy job losses! Need to discuss this ridiculous report

FOMC -all goes back to 4/11/13 Obama/TBTF meeting -claim employment and inflation are key goals (as well as stock market, of course) -fake data, rig markets, and of course attack gold -no correlation with reality, such as tomorrow's expected negative retail sales number

Mining Armageddon -KGC got ball rolling last night with catastrophic report -by next week, nearly all PM majors will report -production will collapse

Comments[0]

|

Tue, 10 February 2015

Tekoa DaSilva of Sprott Global Resource Investments is still high on the resource sector. But he cautions that you've got to buy quality at this point in the cycle. Otherwise you could just be gambling. The major resource companies are poised to prosper when the precious metals cycle finally turns, which it will. There's also a number of companies out there which have large cash hoards and are trading for less than the value of their cash alone. But you've got to look closely and make sure that they're poised for growth. In short, there's much to be excited about for the informed investor.

Comments[0]

|

Tue, 10 February 2015

David Morgan is still a believer in precious metals. While gold and silver have backed off a bit from their New Year's Rally, that doesn't change the reasons why they're going higher in the long term. Global debt continues to increase at geometric rates. Unsound economic and governmental practices haven't changed and when individuals and companies look for safety, they have few other choices available. David also has a special project that he's made available to subscribers that he describes as low risk, high profit potential. All the more reason to pay attention to the Morgan Report.

Comments[0]

|

Tue, 10 February 2015

Bestselling Author and fellow Libertarian Charles Goyette joined us for a discussion of what's going on in America and around the world. While the forces of deflation and inflation appear to be slugging it out, the real loser is the middle class. Charles believes that they are the bulwark against totalitarianism and the protector of freedom. When they decline, freedom declines along with them and that's exactly what's been happening since the crash. Can this trend be reversed? We don't know now and can only hope that the forces of freedom regain the upper hand.

Comments[0]

|

Mon, 9 February 2015

Gerald Celente has been following America's Downfall through his Trends Journal for decades. No need to recount all of his incredible calls. He's disgusted with the quality of leadership in the country. He believes that the people in high places only desire is to keep America mired in war and to keep the populace brainwashed in front of their TV's. It's time to end the madness and that's why he started Operation Peace. He's hoping to mobilize millions to demand peace and bring prosperity back to the land. It's time for a revolution. Start by getting healthy and putting only quality food into your body and quality thoughts into your mind. If enough people do it, there's no stopping us.

Comments[0]

|

Mon, 9 February 2015

Dave Kranzler has been following housing price trends for many years now. Government can spin, create new low downpayment and now downpayment schemes, but if people aren't working or are underemployed, it's going to be very difficult to get the housing market going again. What we're seeing in most of the country, with the exception of the internationally influenced markets like New York City and Miami, is a market that's going nowhere fast and Dave believes it will stay that way into the indefinite future, until something changes in the general economy at large. And when it comes to employment numbers, they were cooked last month just like they've been cooked for years. They're really at depression era levels. The head of Gallup Research finally came out and said so, at the risk of being disappeared. So you can pretty much take it to the Too Big To Fail Bank. Finally, Dave's just put together a report showing that while Amazon is a great company with wonderful service and hard to beat prices, they have a problem; they're not making any money and have been relying upon debt to stay afloat, just like the American Economy. How much longer can they go on like this? Will they go the way of Brick and Mortar retailing?

Comments[0]

|

Mon, 9 February 2015

Gary Christenson has been studying precious metals prices for many years. He has a valuation model that shows that the metals are quite undervalued at this particular moment. The key is filtering out the daily moves and gyrations. That's the time when manipulation takes place. Once you filter this out, you get a clear picture and you understand the true direction and where you need to be investing.

Comments[0]

|

Mon, 9 February 2015

John writes, "Tuesday’s markets really liked hearing that Greece’s new “radical-left” leaders had, once in office, backpedalled on their demand for debt restructuring. Now they apparently just want the country’s unmanageable debt to be rescheduled. See Hopes for Greek Debt Deal Rise After Athens Softens Tone. This, of course, is just semantics. Either a big chunk of Greece’s debt somehow goes away or its economy implodes, so whatever they call the deal it will have to amount to a massive haircut if it’s to prevent a default in 2015. Meanwhile, Syriza’s other policies include reversing electricity and oil privatizations, re-hiring of laid-off public sector workers, scrapping recently-streamlined labor laws, raising the minimum wage and restoring the practice of paying an extra month’s benefits to pensioners. In other words, if given free rein they’ll do exactly the things that always produce a bloated public sector that leads to excessive borrowing that in turn guarantees a currency crisis."

Comments[0]

|

Fri, 6 February 2015

Aaron Clarey has taken on a new and unlikely mission, releasing the Black Man from poverty. His new book The Black Man's Guide Out of Poverty is due to be released shortly. What are his keys to achieving this result? Quite simple actually, stay out of trouble with the law, entrenpreneurship and get away from trouble makers. Seems simple and many of his clients at Asshole Consulting are Black and have hopefully already taken this advice to heart.

Comments[0]

|

Fri, 6 February 2015

Robert and I discuss our weight-loss journeys and how we got serious about restoring our health. It all started with a recognition that something was wrong and that if we didn't change it, we were going to have major health problems down the road. Then a visit to the doctor, some medication, major lifestyle changes and presto weight-loss and our lives have changed for the better.

Comments[0]

|

Fri, 6 February 2015

We sat down with Michelle Seiler-Tucker to discuss the Vaccine debate. For many years children have been forced to receive vaccinations against many diseases. Lately many people have been opting out of the program and once extinct childhood diseases have come raging back. The question is, should parents have the right to decide whether their children should receive these vaccines? Michelle comes down on the side of parental choice. And speaking of choice, there's no better choice to decide to your financial freedom than owning your own business, which Michelle is an expert. But you're almost always better buying an existing profitable business than starting one from scratch. Something else to think about.

Comments[0]

|

Fri, 6 February 2015

Barry Stuppler has been selling precious metals and rare coins for decades. Last year he achieved a major milestone in getting both houses of Congress and the President to pass a major piece of anti-counterfeiting legislation that will help stem the flow of phony precious metals. And it's just in time too, because the market for gold and silver has been heating up since the 1st of the year. With the Euro crisis, Greece, the unpegging of numerous currencies and lots of other trends, currencies are getting riskier by the day. It's no wonder that demand for bullion is going up.

Comments[0]

|

Fri, 6 February 2015

Jordan Goodman is known for his commonsense attitude towards personal finance. He's always looking to help you get that extra edge, whether it's helping you pay your mortgage off decades early or getting extra yield in the safest possible way. He says that low oil prices and the crisis in Europe insure that the dollar's value is going to continue going up. So you need to think outside the box to insure that the value of your investments is stable and to keep on earning healthy returns. He has answers which is why he's called Americas Money Answers Man.

Comments[0]

|

Wed, 4 February 2015

Bill Holter has been observing the current world crisis with increasing alarm. The debt merry-go-round is spinning faster and faster out of control. Now that ECB has begun QE in earnest and the Swiss have broken the Euro/Franc peg, it's hard to imagine how much longer the system will stay afloat. Greece's debts are unsustainable, the derivatives bubble is about to be popped and counter-party risk is about to become the term dujour. Will there be a systemic collapse leading to seizure of the credit markets? Bill thinks it could happen, but we all certainly hope not.

Comments[0]

|

Wed, 4 February 2015

It's been a while since we last connected with our good friend and colleague Jay Taylor. We've learned much from him over the years. One thing is that governments never learn and that they'd rather keep giving out goodies and feeding their socialist programs, the truth be damned. That's one of the reasons the world finds itself in the current crisis, failure to treat its citizens as grown-ups. Until we all understand that there are no free lunches or EBT cards, we can expect the crashes to keep on coming and to keep getting worse and worse.

Comments[0]

|

Wed, 4 February 2015

Bill Still is a former newspaper editor and publisher. He has written for USA Today, The Saturday Evening Post, the Los Angeles Times Syndicate, OMNI magazine, and produced the syndicated radio program, Health News. He has written 22 books and two documentary videos. In 1996 he created the documentary The Moneymasters. He believes that the current world problems can be traced directly to the financial industry's control of the money supply. By allowing large financial institutions to control the creation and supply of monetary units, governments have given up sovereignty and allowed the current crisis to occur. His solution is simple and he believes the results would be fast and effective. Listen and let us know what you think.

Comments[0]

|

Wed, 4 February 2015

Whatever it Takes Wednesdays with Andrew Hoffman: plunging global interest rates -15 nations cutting this year, including China today -negative interest rates, the end of fiat currency

Greece, PIIGS -debt negotiations -votes (Greece, next Spain/France)

U.S economy plunge -layoffs, horrible GDP (with 0% deflator, massive inventory build) -1Q will be horrible

Record gold demand to start the year - 50% above last year's record level -sold out of platinum -U.S. Mint silver eagle sales well above last year's record pace

Unprecedented PM attacks, particularly ahead of last week's COMEX options expiration and after Greek vote

Comments[0]

|

Tue, 3 February 2015

According to Bo Polny gold has broken out. The big resistance is $1300 where the big money is trying to hold it back. Silver outperformed gold in January and it will probably outperform it into the near future. To Bo the trade is on silver rather than gold. The ratio between the two is so out of whack that it virtually has to narrow. As has been said in the past, "Silver is the money of the people, gold is the money of kings."

Comments[0]

|

Tue, 3 February 2015

Craig Bergman, creator of Unfair: Exposing The IRS, is out advocating the abolition of the IRS. He believes that the time has come. The system is antiquated, unfair and unAmerican. Now with Obamacare, your compliance costs have shot through the roof. Americans are wasting over $1 trillion per year, enough to nearly balance the budget. The time is now to contact your senators and congressmen and get the job done.

Comments[0]

|

Tue, 3 February 2015

Sandy Botkin, CPA and Attorney and leading IRS authority says that paying taxes and fear of the IRS due to perceived improper documentation are probably two of the most important concerns among real estate professionals in the country. The real secret that most self-employed taxpayers don’t realize is that tax planning is a year-round activity especially if you want to keep much more of what you make.

Comments[0]

|

Tue, 3 February 2015

Volatility continues to be the buzz word. Stock markets were down for the month. Energy continues to get slammed, big time. The dollar is still going up, which means the Euro is going down. Precious metals seem to have begun their long awaited rise, but it's still too early to know for sure. And bitcoin continues to take it on the chin, with double digit monthly declines.

Comments[0]

|

Mon, 2 February 2015

Martin Armstrong says, "Anyone who claims to be not a doom and gloomer is either a sublime idiot or a fool in denial. This is not a system that can be sustained indefinitely." We agree and have been saying this for years. But that doesn't mean you have to be in a depressive funk. There's always humor to be found in every tragedy. Don't believe it, look at Comrade deBlasio. He's always good for a chuckle, whether he's out killing groundhogs or giving away the store. We also talk about a NYC teach who's gotten lousy reviews for 6 years running, is habitually late and absent and can't seem to manage her classroom. Her penalty, 45 days suspension without pay and more coaching. There's no gloom and doom here at FSN, ever!

Comments[0]

|

Mon, 2 February 2015

John writes about Business Insider's recently posted a Deutsche Bank chart that illustrates the difference between life under the Classical Gold Standard and today’s “modern” forms of money. It’s for the UK only but is a pretty good representation of the world in general:

Comments[0]

|