Mon, 8 September 2014

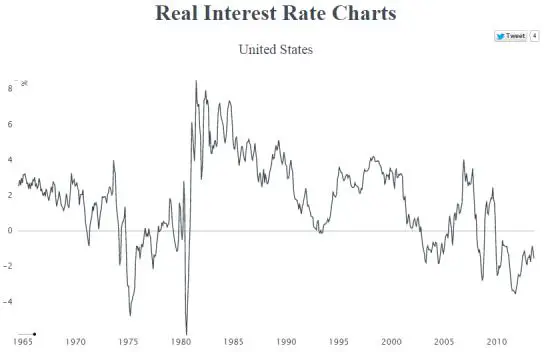

John recently wrote, The folks at Gresham’s Law just published a nifty interactive chart of real (i.e., inflation-adjusted) interest rates since the 1960s that explains a lot about today’s world. To make sense of this, let’s start with a a little background: Interest rates are the rental cost of money, but to figure out the true cost you have to adjust the nominal (or numerical) interest rate for inflation, which is the rate at which the currency being borrowed is falling in value. If the nominal interest rate is higher than inflation, then the real interest rate is positive. If the real rate is both positive and high, that’s a signal that money is expensive and that one is better off being a lender (to reap those high returns) than a borrower (who has to pay the high true cost of money). The opposite is true for negative real rates, where the nominal cost of money is lower than the rate at which the currency is being depreciated. In this case a borrower actually gets paid to borrow because the true cost of the loan falls as the currency loses value. So negative real rates tell market participants to borrow as much as possible.

Comments[0]

|

Mon, 8 September 2014

Global economic collapse -European recession - record debt, near record unemployment, historic plunge in German investor sentiment; -France in outright collapse, Italy triple-dip recession, Spanish banks as insolvent as Portugal; -UK could be thrown into chaos if 9/18 Scottish independence referendum a yes - and now polling that way;

-Japan massive economic data negative revisions this weekend -China housing bubble burst accelerates, which is why the PBOCs PSL, or pledged supplementary lending, QE program commenced last month, following the Yuan devaluation earlier this year -essentially all nations in or near contraction -article references last week: "West to East, Economic Collapse"; "European Economic Collapse, in Simple Math"

ECB - rate cuts (extended NIRP) - $1 trillion QE announced, starting October - article references: "Thursday's ECB meeting could destroy Europe, if Ukraine doesn't first

NFP jobs - 142,000 vs. expected 230,000 - 102, 000 birth/death jobs - 0 manufacturing jobs - 35 year low labor participation rate - a third of all jobs now "temp" - completely refutes "island of lies" U.S. economic data like diffusion indices and weekly jobless claims - Stockman article "why bubblevision misses epic failure in labor market" -just two months ago, Yellen complained of "significant underutilization of labor resources"; and two weeks ago, dedicated here Jackson Hole speech to addressing such fears -article references: "significant underutilization of labor resources"; "jackson black hole"; "what jy and md really said"

"Rising dollar" -new meme of U.S. QE ending and Japan/Europe accelerating, thus creating a "strong dollar" and weaker PM demand -ridiculous in so many aspects, lots to speak of -only against items of real value is "the dollar" to be measured, not other fiat trash -900 million people in Japan/Europe, compared to 300 million in U.S. - sounds like net more PM buying to me

Manipulation Monday -bombshell that CME boasting "governments" and "central banks" as customers, and offering volume discounts to them for overnight PM futures "trading"

Comments[0]

|

Sun, 7 September 2014

When it comes to taxes and the IRS, there's nobody out there like Sandy Botkin. Attorney, author and CPA, Sandy knows how to save you on taxes, big time. In fact he's made a career of it. So listen to the interview, there's at least three important tax saving tips and a number of ways to avoid an audit.

Comments[0]

|

Sun, 7 September 2014

George Matheis, Jr., is an a leading self-defense expert. He's taught thousand how to stay out of trouble and how to get out of trouble once there. He's trained SWAT officer too. Now he tells you what to do when you wind up in a Ferguson type situation. Valuable information in this day and age. Because you never know when it's going to happen to you!

Comments[0]

|

Sun, 7 September 2014

One area where you can save a bundle is auto maintenance. Today's cars are as complicated as the passenger jets of yesterday. But Pam is 4th gen auto expert and she knows every trick in the book for keeping your car running right for hundreds of thousands of miles. When that check engine light goes on, ignorance can cost you thousands, but if you listen to Pam, it doesn't have to. She's written books and shows you how it's done.

Comments[0]

|